Overall concept

Challenges of the European machinery and equipment industry

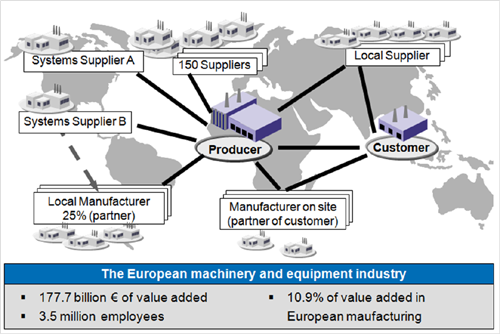

The concept addresses the industry of machine and equipment manufacturers as a specific but very important occurrence of non-hierarchical production networks in Europe.[1] With 178 billion € of added value (10.9% of value added in European manufacturing) the focused industry employs about 3.5 million people.[2] The typical machine manufacturer acts as a prime contractor for his customer and coordinates from development to dispatching order specific networks of several hundreds suppliers and partners worldwide (see Fig. 1)[3].

Fig. 1 – Structure of a typical production network in machinery and equipment industry

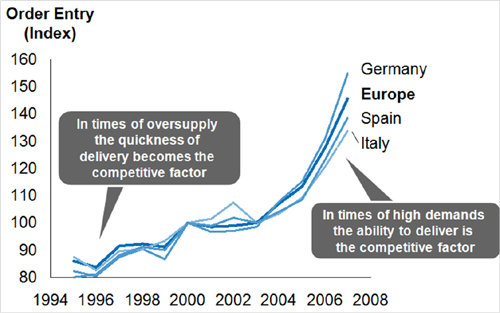

The European machinery and equipment industry can be characterised as highly inter connected dynamic networks. Strong market and technology cycles lead to the stated dynamic network behaviour. The logistic performance of all participants has to permanently adapt to changing market conditions. In times of oversupply the quickest delivery is the success factor, whereas in times of high market demands the ability to deliver is critical for the business. The closed interlinking of the European manufacturing industry can be seen at the order entry indices for different European regions (see Fig. 2). Market peaks and low points are occurring in all European regions almost simultaneously. Furthermore bottlenecks regarding specific supplier goods are not concerning only one producer but generally a phenomenon of the whole European network (for example today’s problems regarding foundry products). Therefore general market information delivers important indicators for the supply chain coordination of a manufacturer in this industry.

Fig. 2 – Economic development in machinery and equipment industry[1]

Another characteristic of the industry is the heterogenic IT landscape. In Europe there are approximately 250 different ERP-systems in use . That is the main reason why most of the order processes are still operated manually via fax, telephone or email. Regarding the number of parts the purchase department would have to monitor it is not a surprise that most of them are ordered without individual validation of the standard replacement times as suggested by the ERP-System. Only a few, usually the most expensive parts, are additionally monitored manually by the following process:

1. Negotiation of delivery date with the suppliers.

2. Negotiation of penalties or bonus for variations from the agreed delivery date.

3. Regular monitoring of the order status through personal contact via telephone, fax or email.

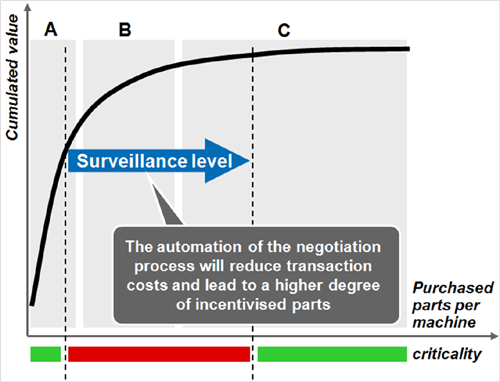

In most cases, this process leads to a successful delivery fulfilment. However, as the purchaser is only capable to perform this time-consuming process for very few articles (normally for less than 5%, see Fig. 3), parts with invalidated standard replacement times can become critical as delays will not be identified until they occur.[4] Finally, the supplier decides autonomously on the sequence of completion of the orders and the possible delay for some of them.

In both cases, the problem for the machinery manufacturer originates from the missing participation in the decision making process. Without the foreground of the actual order status they can often only react afterwards, e.g. by rescheduling order positions. One missing non-substitutable part can therefore stop the whole assembly and jam the space, resulting in short term rescheduling. This leads to turbulences within the production process as quick counter measures have to be found and implemented, thus also delaying subsequent orders. Delays will first spread to the next partners and then to the inter-company network because of the strong cross-linkage and the mutual time dependencies. Thus a chain reaction of turbulence is initiated.

Fig. 3 – Trade-off between transparent delivery dates and the cost of negotiating them

Vision and objectives of inTime

Value proposition of logistic reliability

The costs related to the missing delivery reliability in machinery and equipment industry cannot be quantified fully. Most companies can only estimate their correlative losses. Although penalties for delayed deliveries, extended assembly times and expensive short term logistical actions are quantitative factors, opportunity costs are not. The industry cases within this project have stated that in several occasions they had to pay 0.5% of the project budget per delayed week and 400-600 hours of additional work was necessary. One manufacturer expressed his losses in terms of production efficiency which is reduced by minimum of 15%[5]. Additionally, the manufactures try to protect their internal planning by stocks which could be reduced by up to 30%. Scaled up to the whole machinery and equipment industry this value leads to an amount of 1 billion € per year.[6]

These facts show that an improvement in coordination would have a huge impact for each company in the market. However, there are reasons why this value has not been achieved yet:

- Hierarchical coordination principals have failed: Networks in machinery and equipment industry are non-hierarchical with companies interacting in numerous customer-supplier-relationships at the same time. Big suppliers like Siemens deliver products to tens of thousands of different customers every day. Any hierarchical coordination approach fails due to the complexity of the manifold customer-supplier-relationships and the diverging targets.[7] That is why successful coordination practices from hierarchical industries like automotive or commerce have not been widely accepted in machinery industry.

- Market based coordination fails due to missing transparency: In non-hierarchical networks companies show opportunistic market behaviours. All network participants search for their own optimum. Today the key element to optimise profit is to maximise output while the value of an in time delivery cannot be priced for the majority of parts. Therefore the missing transparency on the value of an in time delivery leads to market failure. Especially in sectors where a shortage of goods is common (like cast parts) the missing incentive to deliver in time leads to permanent delays because manufacturers optimise their schedules according to their output rather than keeping their delivery promises.

- The last reason is that despite of the importance of delivery reliability, in most cases the suppliers do not have transparency over the criticality and the value of an in time delivery for their customers. Therefore they do not have the ability to prioritise between different customer orders.

A new market driven coordination paradigm is necessary !

The market mechanism with its pricing functions is the only known and practicable approach to reach a pareto-efficient allocation of resources in a non-hierarchical network.[8] Therefore the poor resource allocation in the machinery and equipment industry can only be explained by a market failure due to information asymmetry - the unknown value of a reliable delivery. To overcome this market failure, delivery reliability has to become a commonly traded part of the good’s price. Therefore the central research question to be answered in this project is:

|

Can delivery reliability be priced as a commonly traded good? |

How can a market for delivery reliability be realised?

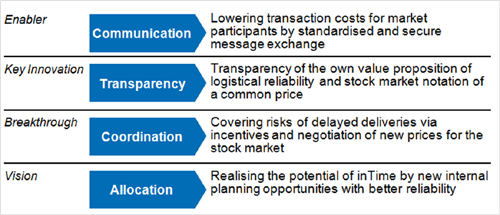

While in many cases today’s cost of determining the price of an in time delivery exceeds its potential, the enabler of the inTime concept (shown in Fig. 4) is to reduce the costs related to information provision and negotiation.

Due to the multiplication of bilateral transactions in a permanently changing network an automated and therefore standardised communication between the participants is necessary. Otherwise the necessary information for the bilateral negotiation functions would exceed the value proposition of the increased delivery reliability.

Transparency to all network participants will be given by a market price for delivery reliability. Therefore a price equivalent for delivery reliability must be found. Whereas the delivery reliability itself will not be tradable independently of the ordered product, the value of reliability can be compared by incentives given in percentage to the price of the product.[9]

Both, customer and supplier will use this price information for the bilateral incentive negotiation. In addition every negotiation beneficiary needs transparency on the internal order situation to level the delivery incentives according to the internal criticality of the order.

The incentive of delivery date adherence becomes the central coordination mechanism to ensure a better planning reliability for the customer. Whereas the information on the incentive structure will be accessible broadly, the negotiation will take place bilaterally between customer and supplier. After the physical delivery of the order the customer will pass the new market price towards the market place.

The pricing and coordination function of inTime will lead to a better network performance by a pareto-efficient resource allocation. Part of the additional value created by a better delivery adherence will be transferred to the supplier to assure this value. The negotiated delivery dates will lead to new planning opportunities which have to be incorporated in advanced production planning functions.

Fig. 4 – Steps to realise a market of delivery reliability

[1] G. Schuh: MyOpenFactory, International Journal of Computer Integrated Manufacturing, 21/2 (2006), p. 215

[2] Source: EUROSTAT 2008

[3] G. Schuh: MyOpenFactory, International Journal of Computer Integrated Manufacturing, 21/2 (2006), p. 215

[4] Assumption: To put every A and B part under surveillance would need about 160 purchasers with the current methods and tools.

[5] Source: FIDIA, OJD and ESTARTA

[6] For a detailed examination of the inTime impact, please see chapter 3.1.

Calculation here: 177 billion € value added in the machinery and equipment industry x 5,82% direct impact

[7] G. Schuh: MyOpenFactory, International Journal of Computer Integrated Manufacturing, 21/2 (2006), p. 215.

[8] The first principle of welfare economics: A free trading of goods in a market leads to a pareto-efficient resource allocation.

[9] The bonus will be added to orders similar to surcharges for precious metal. This surcharge is determined by the actual market price traded at the stock market.

inTime project

inTime project